“There is at least one point in the history of any company when you have to change dramatically to rise to the next level of performance. Miss that moment – and you start to decline.” – Andy Gove

My personal view and experience is that it’s more than one point in time.

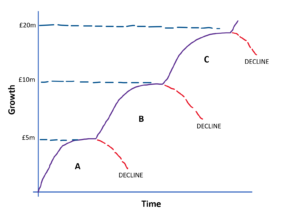

SMEs are characterised by their ability to adapt easily to market changes and their lean organisational structure (not as in Lean Manufacturing), which results in a more dynamic environment and a quicker decision making process. Although SME businesses vary widely in size and capacity for growth generally they will all follow a similar path: going from Owner/Entrepreneur with two or three employees to a business aiming for £10m or even £20m per year, and experiencing 20%/30% year on year growth and upwards along this journey. The sketch below illustrates an example of this, showing where most businesses may feel the pinch points of growth at key intersections.

Zero to £5m

The hard work really kicks in here. This part of the journey is often the one that is the most lonely, but often the most exciting. But it is here that most business owners feel the pains. Because it can be a lonely place, it is easy for owners to doubt themselves, they also don’t know what they don’t know which can be a limiting factor. And as an owner one of the main areas of responsibility is simply getting things done, which means you are working in your business as a manufacturer, and not working on it as a strategic leader.

In smaller SMES, management structures are also small with most owners being very hands-on. People are stretched across all functions all processes. Systems are not in place, IT is minimal or non-existent and there is a lack of standard processes. Utilising the Continuous Improvement and Management graph we can see that all levels are being worked with a very lean structure. Small customer projects, odd-job shop style of working.

As we get closer to a turnover of £5m, it becomes clear that things need to change. We are then moving from that odd-job, one off customer delivery to a mix of bigger projects, possible increased volumes and an increase in market share from your customers. As we start to scale-up from the initial start-up, decisions have to be made about the organisational structure, the company’s technology infrastructure, its business and marketing strategy, etc. With regard to organisational structure, you might now start to see the requirement for supervisory position(s) to take on more of the owners duties, the labour force growing, new machines, loans, investment, functional departments, Operations, Quality, Sales, Technical, Finance. This is where it can be rise or decline with those decisions. In scaling and growth and the opportunities it also brings its own set of problems, (albeit they are nice problems to have because its growth).

£5m to £10m

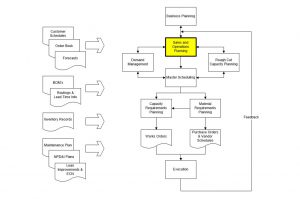

IT Systems and Planning may start to become an issue here, Microsoft Excel may no longer be good enough to manage your shop floor requirements (although I have seen £100m business still using excel but it was beginning to creak), and you are likely at this level to be considering MRP/ERP implementations. You may also look at outsourcing some functions, like Sales, Human Resources, Engineering Support, Quality, Quality Accreditation. All this requires a lot of investment in terms of time, money and energy. You need to do your homework to avoid costly mistakes, especially where IT is concerned, but it’s all opportunity.

And this stage, the business owner is now becoming more removed from the day to day operational tasks on the shop floor. This can be a very uncomfortable feeling in one or two ways. Firstly, the owner may want that hands-on role and not relinquish that part. It could be that the business is now at the stage where the owner is stopping it from growing, the entrepreneurial side is restricted as they are tied to the business. There a number of factors and variables in play, and having the right people is key, being a good leader is fundamental (at all stages).

£10m upwards

Financial Audits are required at this point (although some companies can be exempt if they satisfy certain criteria), so businesses need to be aware of the UK Audit requirements. Similar issues and opportunities still arise, but on a grander scale. Organisational structures are still fundamental, we might now start to see the need for Middle Management. We may also be looking to diversify into new markets, take on bigger orders, and higher volume. From £5m and up, some of your customers may not be the ones you want to deal with now, the one-off, low volume, job shop may not be your ideal customer. You might be seeing more of a need for Product Flow and Cells (Lean Manufacturing is a must from when you first start up), competition is high so you cannot stand still, even if your decision is to stay at a certain level. You will need to be driving for improvements to maintain the status quo, and your service has to be exceptional. Collaboration with a network of Manufacturers and or Partners, in my opinion, is key in this new world, and can bring some fantastic opportunities for growth. Again, IT infrastructure comes into play as the business is getting bigger: more employees, management leadership. The addition of new premises or additional buildings on the same industrial estate (this is where having a world class logistics operations pays dividends in not impacting your efficiency/productivity). The opportunities may now open up bringing the out-sourced services back in house, Sales and Human Resources, etc. At this level, you are likely to be making informed decisions based around data. Strategy alignment throughout the organisation is required, communicated and disseminated so everyone in the organisation knows the direction the company is going in and what the priorities are.

Every business is different. One business’s pinch point may be at £3.5m another’s £7.5m but there will be very similar decisions to be made, but at this level the advantage is that businesses are likely to be able to make these decisions in a more informed way through data. Companies may not achieve sustained profitable growth unless they draft in the specialist skills required at the right time for the business. It’s the maxim that we don’t know what we don’t know. And the best advice is to seek advice from the experts in order to shift the dial in the right direction. This is something we can certainly help with, just contact the number below.

Ask yourself:

How much will it cost you not to resolve the issues that you are currently facing now or in the immediate future? How much will it cost you not to eliminate that pain? What are the lost opportunities on not taking your business to the next level or indeed keeping it at the level you want?

0330 311 2820

Book a Return Call at a time that Best Suits You “HERE”