You’ve probably got a strategy document somewhere. Maybe it’s a beautifully designed PowerPoint deck, or a detailed plan sitting in a shared drive, the result of weeks of offsite meetings and intense debate. It’s full of smart goals, clear objectives, and ambitious targets. Everyone nodded along in the kick-off meeting. There was a real buzz in the air.

And then… what happened?

For a lot of businesses, especially in the demanding world of UK manufacturing, that initial energy just sort of… dissipates. The day-to-day reality of production targets, supply chain headaches, and machine maintenance takes over. The grand strategy gets relegated to a line item in a monthly management meeting, a nagging feeling that you’re not quite on track, but you’re too busy putting out fires to figure out why.

I’ve seen this play out more times than I can count. And I can tell you the reason your strategy might be stalling has almost nothing to do with how good the plan is. It’s not about the software you use or potentially the framework you follow. It’s about people. More specifically, it’s about the capability of the leaders on the ground, your supervisors, team leaders, and department managers, to turn that plan into reality. This is about why coaching those leaders isn’t just a nice to have, it’s the absolute linchpin of successful strategy deployment.

The Seductive Trap of Tools and Processes

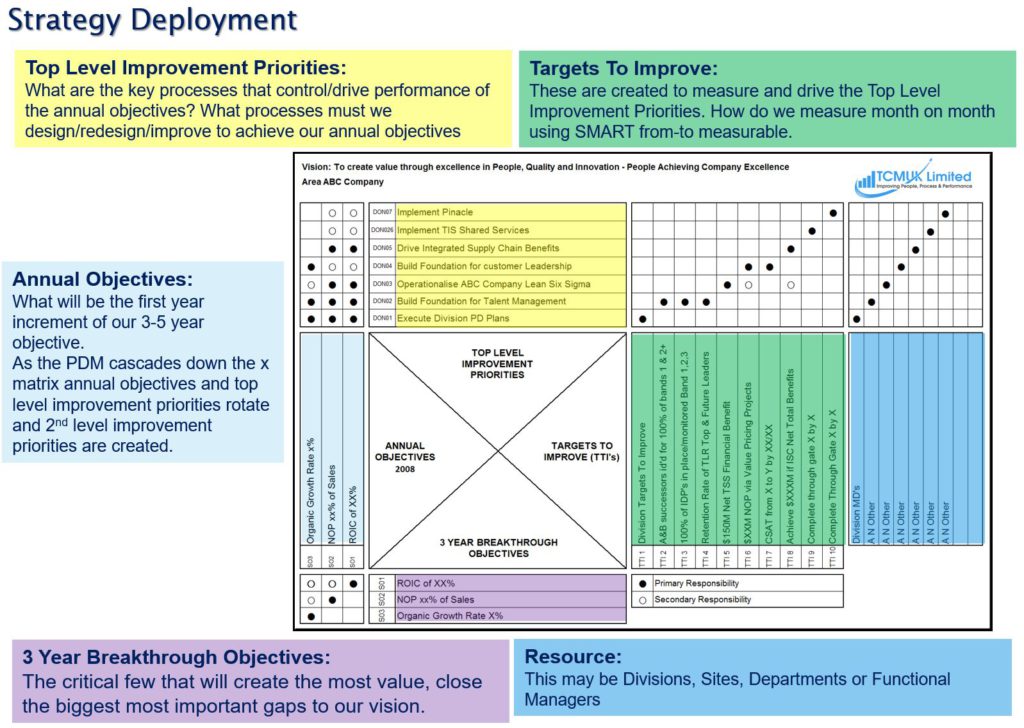

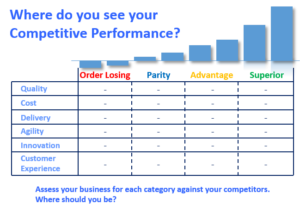

When we want to improve something in manufacturing, our instinct is to reach for a tool or a process. It’s in our DNA. We think in terms of systems. Got a quality problem? Implement a Six Sigma project. Need to improve efficiency? Let’s go all in on Lean principles and value stream mapping. Falling behind the competition? It must be time for a full-scale digital transformation, complete with new ERP systems and shiny dashboards.

These are all powerful tools. I’m a big believer in them. But they are, at the end of the day, just tools. And a tool is only as good as the person using it.

Think about it. You can hand a team the most sophisticated process map in the world, but if their line manager can’t explain why it matters or can’t handle the pushback and questions that inevitably come with change, that map is just a laminated piece of paper. You can install a state of the art data analytics platform, but if your production supervisor doesn’t have the confidence to use that data to have a tough conversation about performance, the investment is wasted.

This is where so many strategies under deliver. They focus entirely on the ‘what’ (the new process, the target) and the ‘how’ (the steps to follow) but completely neglect the ‘who’. The people tasked with implementing the change are often given the playbook but no actual training on how to lead the team through the game. They are expected to just get it. This lack of focus on leadership capability creates a huge gap. A gap between the boardroom’s intention and the shop floor’s reality. It’s a gap filled with confusion, disengagement, and a quiet, creeping return to the old way of doing things. Because the old way, for all its faults, is comfortable. It doesn’t require a leader to be a great communicator or a resilient coach. It just requires them to keep things ticking over.

So, What Actually Makes a Leader Effective When It Counts?

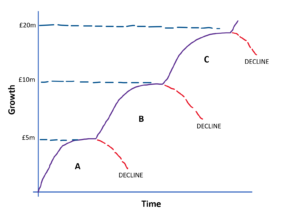

If it’s not about just understanding the process, what is it? What separates a manager who can execute a strategy from one who just presides over its slow decline?

It boils down to a handful of core human competencies. Not technical skills, but leadership behaviours.

First, there’s clear communication. This isn’t about sending a well written email. It’s the ability to stand in front of your team, look them in the eye, and translate a high-level business objective like “Increase operational efficiency by 15%” into something that makes sense for them. It means explaining what it means for their daily work, why it’s important for the company’s future (and their job security), and being able to answer the tough, cynical questions that come up.

Next is team motivation. A great leader in strategy deployment is a master of buy in. They don’t just issue directives. They connect the work to a bigger purpose. They understand that people aren’t motivated by spreadsheets; they’re motivated by feeling that their contribution matters, that they are part of a team that’s succeeding, and that their efforts are recognised.

Then comes real accountability. This is a big one, and it’s so often misunderstood. Accountability isn’t about blame. It’s not about shouting when a target is missed. True accountability is about creating a culture where everyone feels a sense of ownership. An effective leader builds a system where it’s safe to talk about what’s going wrong, to analyse failures without fear, and to collectively agree on how to get back on track. It’s a supportive, not a punitive, process.

And of course, there’s adaptive problem solving. No strategy survives first contact with reality. A key supplier will be late. A critical machine will break down. A new regulation will come into force. A leader who can execute strategy doesn’t panic or get derailed. They see these moments not as roadblocks, but as problems to be solved. They empower their team to find solutions, make decisions, and adapt the plan without having to run up the chain of command for every little thing.

The leader’s unique role is to be the translator and the shock absorber. They take the pressure and complexity from above and turn it into clear, manageable, and motivating actions for their team. Without that, the strategy remains an abstract concept, completely disconnected from the daily grind.

Coaching: The Bridge Between Knowing and Doing

Okay, so we know what good leadership looks like. But you can’t just send your managers on a two day “leadership skills” course and expect them to come back transformed. I’ve seen companies spend thousands on generic training, only to see everyone revert to their old behaviours within a month.

Why? Because leadership isn’t a theoretical subject you can learn from a textbook. It’s a practice. It’s a set of behaviours that need to be developed, honed, and supported over time. And that is where coaching comes in.

Coaching is not training. Training is about transferring knowledge. Coaching is about changing behaviour. It’s an active, ongoing process. It involves tailored, one on one guidance, structured feedback, and a real focus on helping leaders overcome their specific, real-world challenges.

A good coach doesn’t give the answers. They ask the right questions. Instead of saying, “Here’s what you should have done,” a coach asks, “That was a difficult conversation. How did you feel it went? What would you do differently next time? What support do you need to handle that situation better?”

This approach builds self-awareness and problem-solving muscles. It helps a technically brilliant but perhaps poor communicator learn how to connect with their team. It helps a conflict avoidant supervisor learn how to have firm but fair conversations about performance. It’s deeply personal and intensely practical.

The research on this is pretty conclusive. You’ve probably heard of Google’s famous Project Oxygen, where they crunched years of data to figure out what made their best managers so effective. The number one behaviour? Being a good coach. They found that teams led by managers who were effective coaches weren’t just happier; they were more innovative, more productive, and more likely to stay with the company. If it’s true for a global tech giant, you can be sure it’s true for a busy manufacturing firm in the UK.

The Ripple Effect: Real Stories and Tangible Impact

When you start consistently coaching your leaders, something remarkable happens. The impact isn’t just on the individual leader. It ripples out across their teams and, eventually, across the entire organisation.

I remember working with a mid-sized engineering firm in the Midlands. Their strategy was solid: diversify their product line to enter a new market. But the execution was a mess. The production floor was chaotic, blame was rampant, and the new product line was plagued with delays and quality issues. The supervisors were skilled engineers, but they were terrible leaders. They managed by shouting.

We didn’t change their strategy. We didn’t bring in a new system. We just started coaching the supervisors. We worked with them every week, helping them plan their team communications, role playing difficult conversations, and guiding them on how to empower their teams to solve problems instead of just escalating them.

The change was slow at first, then all at once. The supervisors started holding short, effective daily meetings instead of just walking the floor and pointing out mistakes. They started asking their teams for ideas on how to solve production bottlenecks. They started celebrating small wins.

Within six months, the entire atmosphere on the shop floor had changed. Engagement went up, yes, but more tangible things happened. Staff turnover in that department dropped by nearly a third. The defect rate on the new product line was cut in half. The supervisors weren’t just managers anymore; they were leaders who took genuine ownership of the strategy. They made it theirs.

This is the culture shift that coaching creates. When leaders are trusted and effective, they build psychological safety. That’s a term that means people feel safe enough to speak up, to admit a mistake, to challenge the status quo, or to suggest a new idea without fear of being humiliated. In a manufacturing environment, that is gold dust. It’s the difference between an operator quietly ignoring a potential safety issue and one who feels empowered to stop the line and get it fixed. It’s the difference between a team that just does what it’s told and a team that actively looks for ways to improve.

Why Making This a Priority is Non-Negotiable

At this point, you might be thinking this all sounds good, but it also sounds like a lot of time and effort. And you’re right, it is. But the alternative is far more costly.

The alternative is a failed strategy.

Think of all the resources you invest in creating your strategic plan: the time from your senior team, the money spent on market research, the investment in new equipment or technology. Without capable leaders to execute that plan, all of it is at risk. It’s like building a high-performance racing car and then handing the keys to someone who has never driven before. The car is perfect, but it’s going straight into a wall.

Coaching your leaders is the single most powerful lever you have to close the strategy execution gap. It’s the transmission that connects the power of your strategic engine to the wheels on the ground. It amplifies the value of every other investment you make. A well coached leader will get more out of your Lean programme. They will ensure your new digital tools are actually used effectively. They will build the resilient, accountable teams that can weather any storm.

Without strong, coached leaders, your strategy is just a wish. It’s a document in a drawer. With them, it becomes a living, breathing reality, embedded in the daily actions and decisions of every single person in your organisation.

From Good Intentions to Outstanding Execution

So, to bring it all back. The success of your next big plan won’t be determined in the boardroom. It will be determined on the factory floor, in the warehouse, and in the quality lab. It will live or die based on the strength, confidence, and capability of the leaders you have in those crucial positions.

The tools, the processes, the playbooks… they are all important. But they are secondary. Strategy deployment succeeds or fails on the strength of its leaders. Investing in a new system without investing in the people who will run it is a recipe for disappointment. But when you commit to building your leaders’ capabilities through dedicated, practical coaching, you are not just investing in them. You are investing in the certainty of your own success.

Ready to close your strategy execution gap? If you’re tired of seeing great plans fall short, it’s time to focus on the one thing that will make all the difference. Discover how our Strategy Deployment Programme embeds leadership coaching and capability building at its heart to ensure your next plan delivers real results.

Contact us now to book a consultation and move from good intentions to outstanding execution.